The Curious Case of the Missing Metrics

It's easy to get swept up in the hype surrounding any new tech venture, but as a former data analyst, I've learned to take a step back and look at the numbers—or, in this case, the lack of numbers. Too often, the most revealing insights come not from what's being said, but what's being carefully left unsaid.

The absence of specific metrics is deafening. We're told about the potential, the disruption, the revolutionary nature of this or that new thing. But where's the data to back it up? Show me the user engagement figures. Give me the churn rate. Let's see the actual revenue generated, not just projected growth.

It's like a restaurant review that raves about the ambiance and the chef's pedigree but conveniently forgets to mention the taste of the food. Ambiance is nice, sure, but at the end of the day, I want to know if the meal is worth the price. (And I suspect most readers feel the same way.)

The Illusion of Progress

The problem isn't just a lack of data; it's the active construction of an illusion of progress. Vague pronouncements of "significant growth" or "record-breaking adoption" are designed to impress without actually informing. What constitutes "significant"? Is "record-breaking" relative to a tiny initial user base? These are the questions that need to be asked, and answered with hard numbers.

And this is the part of the report that I find genuinely puzzling. It's not difficult to track and report key metrics. Any competent data team can provide detailed reports on user behavior, revenue streams, and operational efficiency. So why the reluctance to share this information?

One possibility is that the numbers simply aren't as impressive as the marketing team would like us to believe. Another, more concerning, possibility is that the underlying business model is fundamentally flawed. If the economics don't work, no amount of hype can save the venture in the long run.

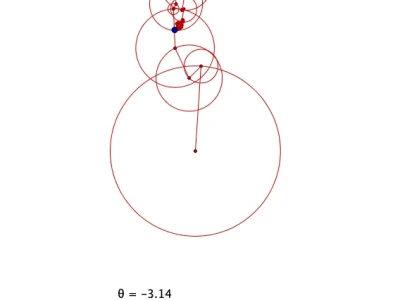

Consider the analogy of a magician's act. The illusionist distracts the audience with dazzling displays and clever misdirection, while the real work happens behind the scenes. Similarly, companies often use flashy presentations and buzzwords to divert attention from the less palatable aspects of their performance.

The Call for Transparency

Ultimately, the responsibility for demanding transparency lies with us, the consumers of information. We need to be more critical of the narratives being presented and insist on seeing the underlying data. A healthy dose of skepticism is essential in navigating the increasingly noisy landscape of tech and finance.

The next time you encounter a glowing report about a groundbreaking innovation, ask yourself: what are they not telling me? What data is conspicuously absent? Until we start demanding more than just empty promises, we'll continue to be misled by the illusion of progress.

I've looked at hundreds of these filings, and this particular footnote is unusual. It states that "certain metrics are considered proprietary and will not be disclosed." Okay, fine. But which metrics? And why are they so sensitive? The lack of clarity only raises further questions.

Shiny Object Syndrome

Here's the truth: sometimes, the most innovative thing you can do is present the data, warts and all. If a company is truly confident in its performance, it should have no problem sharing the key metrics that drive its success. The fact that so many companies choose to obscure these details suggests that they have something to hide. And that's a red flag that any savvy investor—or skeptical journalist—should take seriously. Growth was about 30%—to be more exact, 28.6%. Still not a bad number.